Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Once upon a time, in a bustling city, lived two twin brothers: Tom and Jerry. Both of them fresh out of college and brimming with ambition, they embarked on their professional journeys, landing jobs at the same company with identical salaries of $75,000 per year. Like two peas in a pod, they also shared the same dreams of marriage, children, and a comfortable retirement. With their eyes set on the future, they will embark on their journeys towards financial security in vastly different ways.

With an eye on the long-term, Tom hoped his disciplined approach would secure a comfortable retirement for him and his family.

Tom diligently adhered to conventional wisdom, saving his earnings in the ways all of us in the work force are first taught. Each year, he set aside 10% of his income. He allocated the traditional 6% ($4,500) for his 401(k), enabling him to take advantage of the benefits of his employer’s matching contribution as well. With his remaining 4%, he contributed to his Roth IRA, ensuring he also had a tax-free income stream in retirement.

With aspirations of homeownership, Tom squirreled away $4,800 per year into a regular savings account for a down payment on his family’s first home. He also understood the importance of safeguarding his family’s future with a Million Dollar Term Life Insurance policy, costing him another $720 annually.

Meanwhile, Jerry took a different path guided by a financial professional, who created a savings plan customized to his plans for his family’s future.

Embracing the power of life insurance, he saw potential to truly take control of his own retirement. Jerry chose to invest in an Indexed Universal Life (IUL) insurance policy, recognizing its unique ability to simultaneously grow and leverage his savings while safeguarding his loved ones’ financial future all in one.

He mirrored Tom’s financial commitments, setting aside the same $7,500 out of pocket retirement savings and $4,800 savings for his home per year into his IUL policy, which included his million-dollar coverage so he added another annual $720. In doing so, Jerry knew he was ensuring a robust foundation for his retirement nest egg while providing invaluable protection for his family.

It was the best of times, it was the worst of times. Each brother had his plan in place to weather whatever life will through at them. Now lets see how both brothers’ plans play out as they go forward with their lives.

Five years after college Tom finds himself in need of a new car and approaches a bank for traditional financing. He applies and is approved for the $30,000 loan, locking him in to paying that bank $7,200 each year for the next five years.

After ten years of diligent savings toward his dream of a house, Tom pulls the $50,000 that his savings account has accrued to use as a down payment. His savings account is now starting back at zero, of course.

In the 13th year of Toms financial journey he is again looking for a traditional auto loan from a bank, this time for $40,000, putting his yearly payments up to $9,600 for the following five years.

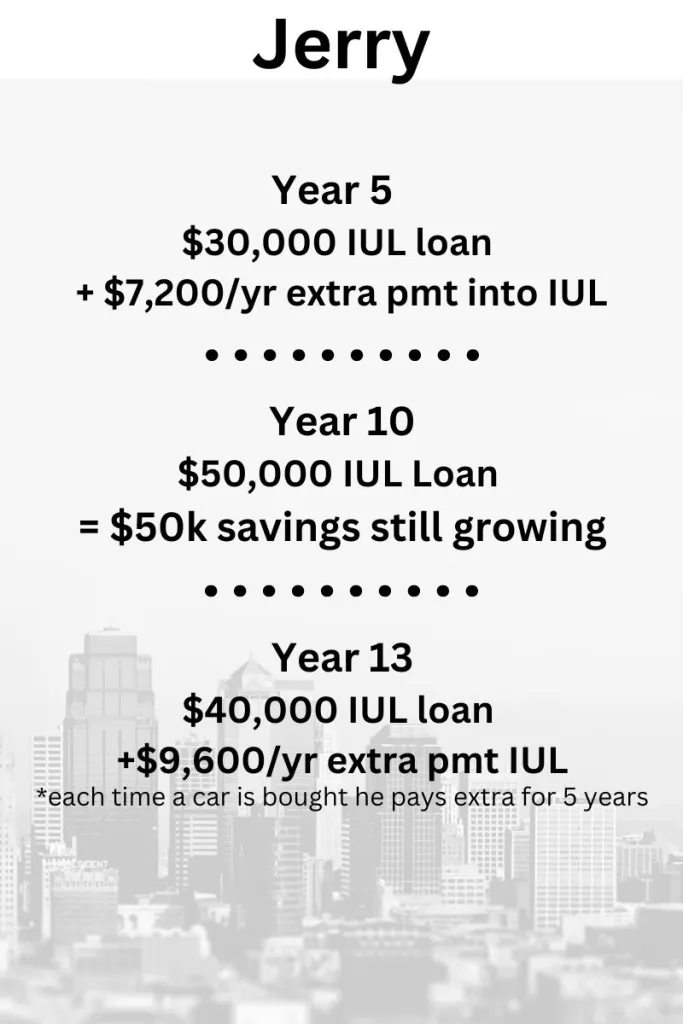

Jerry has set himself up for a very different financial future, enabling him to leverage his savings and run his large purchases through the IUL strategy that he and his financial professional put together specifically to meet his needs.

Just like his brother, Jerry needed a new car after five years. Unlike his brother, however, he didn’t need to approach a bank or qualify for his $30,000 loan. He was able to take this loan out from his life insurance company and ensure himself a low interest rate with no structured repayment plan. He did decide to pay the same $7,200/ year as his brother for five years, but this sum went into his savings for retirement instead of to a bank.

He found a house he loved after his ten years of saving, so Jerry took out another loan from the insurance company for the downpayment. Even though he had taken $50,000 and made his downpayment, his savings was still growing for him undisturbed.

He does this one more time in year 13, to buy another car for $40,000. He puts the same $9,600/yr for the same five years into his savings that his brother paid to a bank.

As the years passed, Tom diligently saved and invested, meticulously planning for the future. However, unforeseen expenses and the rigidity of traditional retirement accounts posed unforeseen challenges. Tom found himself grappling with car loans, mortgage payments, and the limitations of his retirement savings vehicles. Despite his best efforts, Tom’s retirement income only stretched until age 72, leaving him with a modest net distribution of $1,746,502.

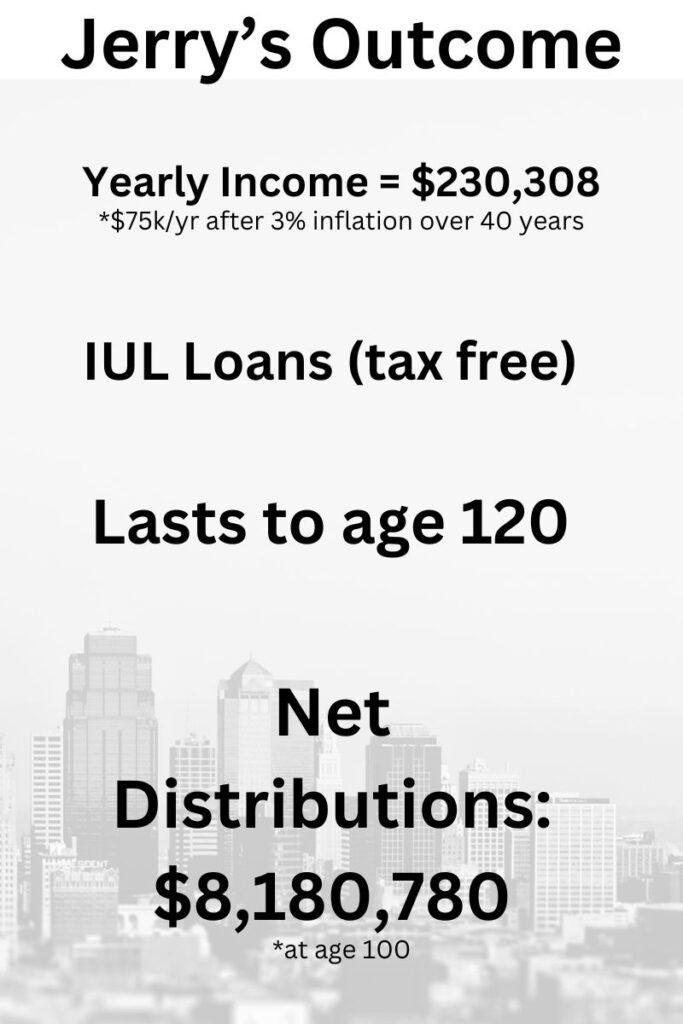

In contrast, Jerry’s strategic approach to retirement planning bore fruit in abundance. Leveraging the flexibility of his IUL policy, Jerry seamlessly navigated life’s twists and turns, borrowing against his policy as needed while continuing to grow his savings. His tax-free distributions provided a steady stream of income that lasted well beyond retirement age, ensuring financial security for himself and his family. At age 120, Jerry’s retirement fund boasted a staggering net distribution of $8,180,780, securing his family’s future for generations to come.

And so, in the best of times and in the worst of times, having a strong financial plan that leverages the money in your savings allows you to act as your own bank and live your life on your own terms. If you do not currently have a cash value life insurance policy, myself or someone on my team would be happy to take you through some of your options.